OEMs and the broader ecosystem are accelerating the development of electrification of vehicles, creating infrastructure and developing new support networks. At the same time, consumer interest is skyrocketing and their demand for electric-vehicle-specific experiences is growing. Harman believes “we are at the precipice of a rare opportunity that if actioned on, will fast-track EV adoption and change our roads, how we drive, and even where we go.”

So, Harman and partner SBD Automotive commissioned a new industry report focused on EVs and how the current shift towards vehicle electrification is impacting the consumer experience in the car, presenting new opportunities for OEMs and consumers. Developed by its EPM Advisory Council, a collaboration of exclusive automotive and technology stakeholders aimed at solving the complex issues facing the industry, the Experiences Per Mile (EPM) consumer study shows opportunities for consumers and the road ahead for EV experiences.

A rare opportunity for OEMs

The EV growth trend is a rare opportunity to conquest customers from less-progressive OEMs during this global electrification race.

Some traditional global OEMs have announced electrification targets, with automakers Mercedes-Benz, GM, JLR, and Volvo having committed to offering EVs in the near future. While other carmakers have not committed to complete electrification of their fleets, investment strategies are still very significant with nearly $330 billion being committed to offering electric vehicles from traditional brands.

It should be noted that Japanese carmakers have either not made public commitments or are just now starting to focus on electrification, primarily due to the Japanese government’s prior lack of support for fully electric vehicles and the focus on fuel-cell technology.

This all comes in response to the pressure that traditional carmakers are feeling (detailed above). Early movers such as Tesla, other EV pure-play startups like Rivian and Lucid, as well as Chinese domestics and spinoffs, have received massive investments and have capitalized on strong growth in global financial markets through reverse mergers (known as SPACs) and public offerings.

Experiences Per Mile report and council

The report was written by members of the EPM Advisory Council, an organization formed to address key issues in the industry, driving innovation and supporting member initiatives to improve and capitalize on the EV-X (Electric Vehicle-Experience).

Mobility is more than getting from one place to another. It’s about shifting from one state of being to the next. The Experiences Per Mile vision gives people ownership of their experience in the car and transforms the value they place on the car and overall mobility experience.

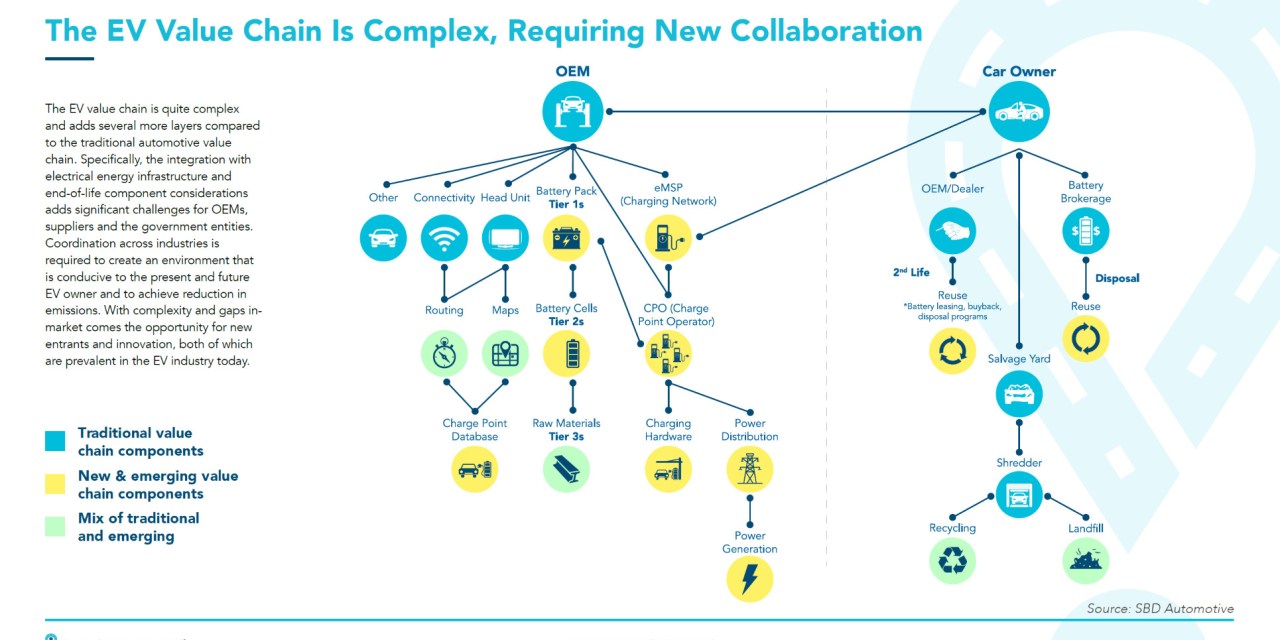

HARMAN and SBD Automotive, together with industry partners and stakeholders, is transforming the industry and media dialogue through the recently formed Experiences Per Mile Advisory Council. The purpose of the council is to align automakers, Tier-One suppliers, third-party providers, and other industry leaders, and to encourage collaboration regarding the changing value chains in the automotive industry that are being driven by the connected movement.

Active discussions focus on intelligent technology, evolving consumer trends, and how they’re both reshaping the experience inside the vehicle as well as what this means for automakers and consumers alike. There’s an urgent demand for consumer-centric, in-vehicle, and mobility experiences and the most forward-thinking industry members must get involved now to drive a significant change. The council is shaping the future of EPM with a mission to promote collaboration, establish processes and elevate the complete automotive ecosystem.

Overall importance of EV Experience

Each ownership phase will be approached differently depending on an individual’s personality or persona. The SBD Automotive Consumer Survey shows that even 50% of laggard consumers are already considering an EV, increasing steadily across the segmentation to 98% of early adopters. This clearly points to adoption as a question of when, rather than if someone will buy an EV.

When considering the late majority and laggard consumers who will continue to encompass more of the target market over the next decade, understanding their perceptions, needs, and hesitations is critical to support adoption and positive Experiences Per Mile.

These consumer groups can view technology as ‘intrusive’ or ‘something to break away from,’ while some find it ‘overwhelming and complicated,’ but also a ‘statement of success.’ The context of consumer personas can help in developing products and services that meet the needs of diverse consumer groups, while also supporting stakeholders who engage in educating and promoting technology.

The report looked at and made suggestions for EV before, during, and after EV ownership.

Pre-ownership

Dealers play an important role in pushing consumers towards or away from electric vehicles, with varying motivations for each approach.

Typically, dealers are self-motivated to sell higher-priced models and since most EVs are priced higher than their ICE counterparts, it would seem natural for dealers to push EVs. However, many automakers are struggling to meet EV demand, due in part to OEMs’ lack of marketing (until recently), incentivization, profit margins, and available EV stock. SBD’s research suggests a clear association of willingness to adopt an EV with dealer knowledge.

“Framing” is a behavioral bias that presents choices, or options in a positive way for the consumer. A savvy, knowledgeable dealer will “frame” a barrier properly. An example of this is highlighting the lack of charging points early but positioning the problem as one surmountable by public infrastructure development efforts and/or private charge point ownership. This upfront acknowledgment can help reduce the barriers perceived during ownership.

Additionally, lack of onsite dealership stock impacts a customer’s ability to test drive a new EV, which can have a greater impact on the purchasing experience than it would for a traditional vehicle that can be compared to past experience or more closely simulated with alternate models or trims that are available onsite.

Ownership

The fundamental difference between the ownership experience of an ICE vehicle and an EV is the traction battery and the need to charge it. This requirement affects a vast majority of the ownership experience from private infrastructure purchase & management, public infrastructure awareness & navigation, to life-cycle performance and degradation implications. OEMs and suppliers are working to support the ownership experience as it intersects other industries and creates new experiences that can affect their brands.

A poor experience at a gas station is highly unlikely to impact a consumer’s brand perception of their vehicle, while a poor charging experience is more likely to play a role in forming brand perception, especially given the white-labeled and proprietary charging networks being provided or suggested to consumers.

The automotive industry is experiencing accelerated innovation across vehicle technology, and electric vehicles are flagships for new, highly connected features. These can be directly related to the electric powertrain, or independent and geared towards the Internet of things (IoT) and the push to create in-cabin experiences that are consistent with high technology standards stemming from smartphones and consumer electronics.

With respect to powertrain differences, the ease of finding charging stations and efficiently completing the charging process is critical. OEMs and mapping providers are partnering directly with charge point operators (CPOs) and e-mobility service providers (eMSPs) to bring charge point data to the in-vehicle and companion app interfaces.

Key improvement opportunities highlighted involve:

- Improve real-time charge point data

- EV In-Vehicle Infotainment Features: Experiences While Charging

- EV Charging and Cybersecurity

- Thermal Management and EV HMI Implementation

- Updating EVs – Over-the-Air (OTA)

- Dealer Knowledge Plays a Role in Repeat EV Purchasing

Post-ownership

Given the world is moving towards an entirely Electric Vehicle future, the fact that around a quarter of current EV owners remain unsure whether they would remain in an EV highlights there is still work to be done even among the converted audience. Dealer knowledge and the ability to educate or support the consumer is also a concern for retention, as those less likely to buy another EV were more likely to claim their dealer had limited knowledge.

Given wider marketplace issues compared to traditional vehicle ownership, communication and support have a bigger impact on consumer sentiment. Managing the expectation of owners from the outset helps customers have a more positive experience and increases the likelihood they will remain in an EV.

Currently, the secondary market for EVs is nascent but this will change in step with EV park growth as primary sales targets are achieved. Several concerns remain with respect to residual value and battery longevity, and this is a strong focus for many industry stakeholders.

Conclusion

In summary, Experiences Per Mile are different for EV owners compared to ICE owners, requiring new considerations, industry collaboration, and EV-centric design to support consumers as they make the transition to electric vehicles. It is no longer a question of if, but when, will the mass adoption of EVs affect your business, the report’s authors say.

As consumer preference changes, so will their experiences. As vehicle powertrains are shifting, so is the connected world, colliding to create new opportunities and hyper-individualized experiences that solve for real consumer needs. Stakeholders across the automotive ecosystem are working to help people maximize the time they spend in and outside of the car.

In early 2022, the EPM Advisory Council will release the results of an EPM Metric Exploratory Research Study which will reveal if Experiences Per Mile can be evaluated and measured by consumers through a unique vehicle segment test. The results of the study will be released publicly and will be announced on the www.experiencespermile.org website.

- Motivations for buying an EV differ considerably by region.

- Year-over-year BEV sales growth and key market drivers.

- OEM EV commitments.

- The EV value chain is complex, requiring new collaborations.

- Lack of charging points is the biggest barrier for all Consumers.

- The report is by way of Harman’s Experiences Per Mile Advisory Council.